Decoding Used Car Markets: Germany vs. Italy

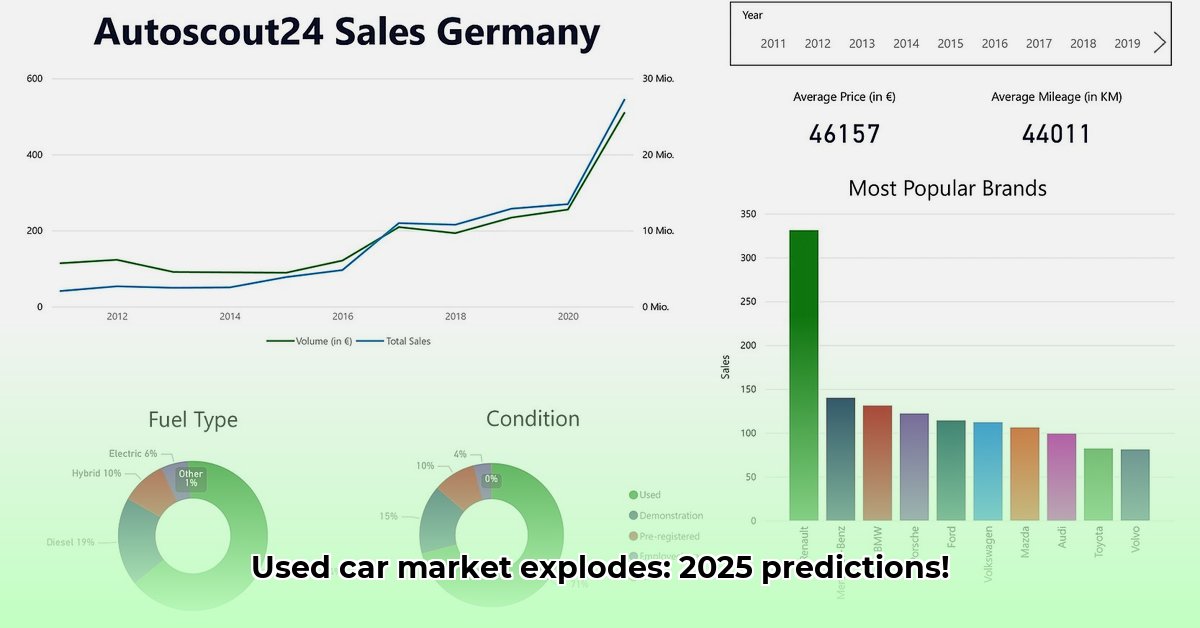

This report analyses used car market trends in Germany and Italy, leveraging data from Autoscout24 to provide actionable insights for dealers and consumers. Significant differences exist between these two markets, impacting pricing, vehicle demand, and overall market dynamics. Understanding these nuances is crucial for making informed decisions.

Key Differences: A Snapshot

- Fuel Type Preferences: Germany shows a strong preference for hybrid vehicles, reflecting a growing environmental consciousness and government incentives. Italy, however, maintains a significant demand for petrol and diesel cars, although hybrid adoption is increasing.

- Pricing Discrepancies: Direct price comparisons between Germany and Italy are challenging due to variations in vehicle condition, mileage, features, and regional differences. Further complicating matters is the inconsistent availability of key data points across listings.

- Data Transparency Challenges: Inconsistent fuel consumption data reporting (NEDC vs. WLTP) across Autoscout listings hinders accurate comparisons of fuel economy. This lack of standardised information presents a significant hurdle for both buyers and sellers.

Germany: The Rise of the Hybrid

Germany's used car market is experiencing a notable shift towards hybrid vehicles. Models like the Hyundai i30 48V are particularly popular, driven by environmental awareness and supportive government policies promoting eco-friendly transportation. However, the long-term sustainability of this trend remains uncertain, potentially influenced by advancements in electric vehicle technology. Is this surge a temporary phenomenon or a permanent shift in consumer preference? Further research is needed to answer this pivotal question.

Italy: Petrol and Diesel Still Hold Strong, But Hybrids are Gaining Ground

The Italian used car market presents a contrasting picture. Petrol and diesel vehicles, including popular models like the Maserati Ghibli and Audi Q5, remain significant players. This is possibly due to existing infrastructure and consumer habits, but the growing popularity of hybrid cars signals a potential shift in the market structure. What regulatory changes or developments could accelerate this transition in Italy? This is crucial for dealers to prepare. Italian dealers must adapt to meet this growing demand, integrating hybrid vehicle maintenance and financing methods into their business strategies.

Pricing Strategies: Navigating the Complexity

Comparing prices directly across German and Italian Autoscout listings poses considerable challenges. Factors like vehicle condition, mileage, and additional features significantly influence pricing, making direct comparisons unreliable. Even within a single country, prices fluctuate regionally. How can we enhance data standardization within Autoscout to enable more meaningful price comparisons? This is a critical question for platform improvement.

Fuel Efficiency Data: A Critical Gap

The inconsistent reporting of fuel consumption data (NEDC vs. WLTP) represents a major obstacle for accurate comparisons. How can we achieve greater consistency in fuel consumption data to empower both buyers and sellers with critical information? This would facilitate more informed decision-making across the board. A lack of standardized data is a significant issue for both buyers seeking fuel-efficient options and sellers needing to accurately assess the value of their vehicles.

Actionable Strategies for Stakeholders

Based on our analysis of Autoscout data, we provide the following actionable recommendations for different market stakeholders:

Dealers (Germany & Italy): Invest in training on electric and hybrid vehicle maintenance. Improve data accuracy and reporting on your listings, especially concerning fuel consumption and vehicle history. Adapt your stock to reflect changing consumer preferences.

Buyers (Germany & Italy): Conduct thorough research on fuel efficiency and running costs. Prioritise listings with accurate and standardised fuel consumption data. Employ independent valuation services to determine fair market price.

Autoscout24: Implement measures to ensure greater consistency in data reporting across all listings. Develop a standardized reporting structure for fuel consumption data (e.g., exclusively using WLTP figures). Improve search functionality to allow more precise filtering based on detailed fuel consumption data.

Risk Assessment Matrix

| Risk Factor | Risk Level | Mitigation Strategy |

|---|---|---|

| Changing Demand for Hybrids | Medium | Monitor market trends and adjust inventory accordingly. |

| Poor Data Quality | High | Improve data quality control and reporting standards. |

| New Emission Rules | Medium | Stay informed on upcoming regulations and adapt pricing strategies. |

| Economic Slowdowns | High | Implement flexible pricing strategies and manage costs efficiently. |

Conclusion: Adapting to a Dynamic Market

The used car markets in Germany and Italy are dynamic and present both opportunities and challenges for dealers and consumers alike. By understanding these trends, leveraging available data effectively, and adapting to market changes proactively, all stakeholders can improve their success in this ever-evolving sector. Ongoing research and data analysis will continue to refine our understanding of these complex markets.